Have you ever really looked at your credit card statements and the estimated repayment information they provide? The path you choose can make a huge difference.

Here’s another REAL LIFE, REAL FREEDOM member story!

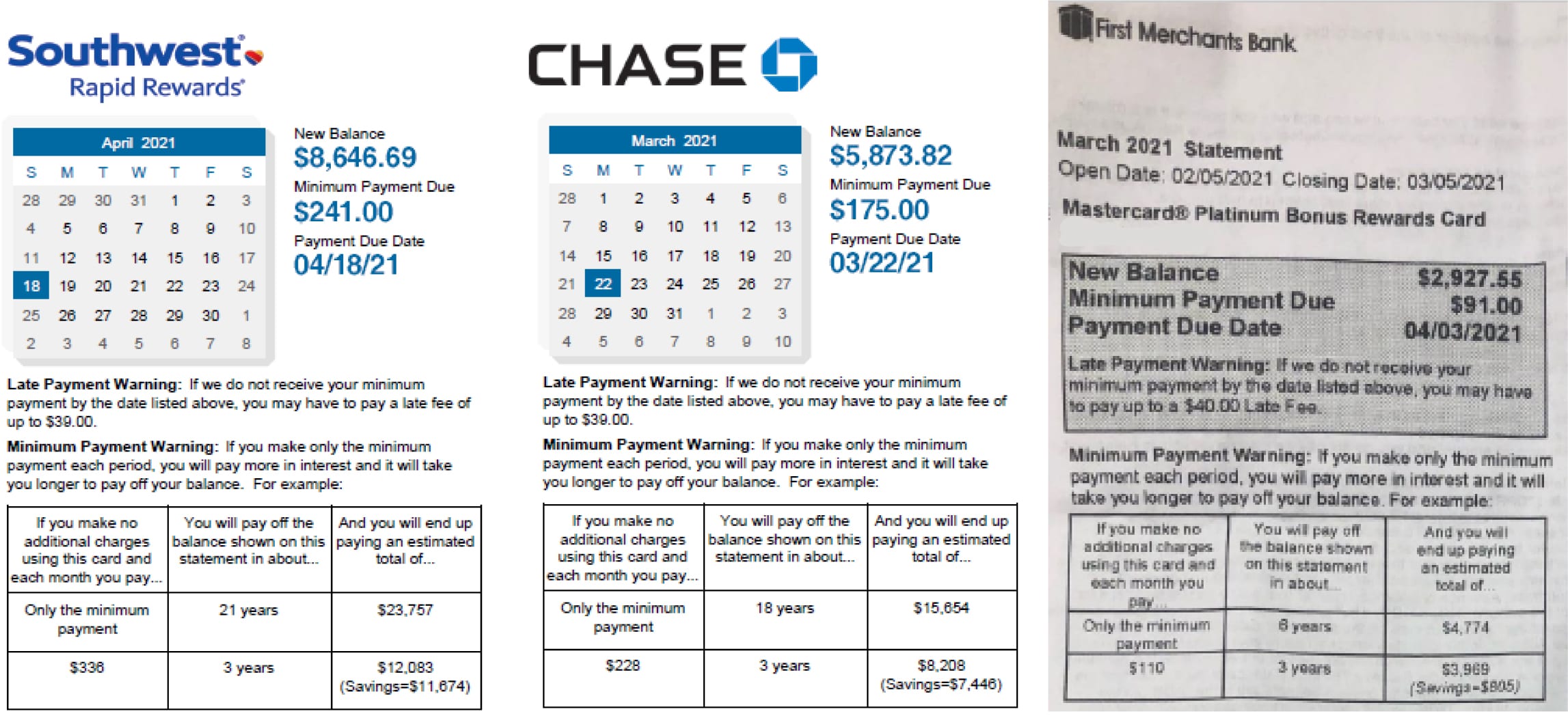

A member came to us with three credit cards he wanted to consolidate. The balances totaled $17,448. Let’s take a closer look at the details.

The credit card company provides two examples.

- The first is when only the minimum payment is made

- The second is when the payment allows for the card to pay off in 3 years

| Example when MINIMUM PAYMENT is made | |||||

| Balance | Minimum Payment | Years to Repay | Estimated Repayment | Interest Repayment | |

| Card 1 | $8,647 | $241 | 21 | $23,757 | $15,110 |

| Card 2 | $5,874 | $175 | 18 | $15,654 | $9,780 |

| Card 3 | $2,928 | $91 | 6 | $4,774 | $1,846 |

| $17,448 | $507 | $44,185 | $26,737 | ||

| Example to PAY OFF in 3 YEARS | |||||

| Balance | 3 Year Payoff Payment | Years to Repay | Estimated Repayment | ||

| Card 1 | $8,647 | $336 | 3 | $12,083 | $3,436 |

| Card 2 | $5,874 | $228 | 3 | $8,208 | $2,334 |

| Card 3 | $2,928 | $110 | 3 | $3,969 | $1,041 |

| $17,448 | $674 | $24,260 | $6,812 | ||

There is significant savings in both years to repay and the total estimated repayment when you can commit to the higher monthly payment. Paying an additional $167 per month did not work for this member’s budget.

We provided another option.

| Consolidation loan with Natco | |||||

| Balance | Monthly Payment | Term | Estimated Repayment | Interest Repayment | |

| Loan | $17,815 | $517 | 48 | $23,406 | $5,591 |

In the end, the member benefits in several ways!

- The full balance will pay off in just 4 years.

- The monthly payment of the consolidation loan is only $10 more per month than the minimum payment required on all three cards but includes credit life and credit disability insurance.

- The rate is approximately 10% less on the consolidation loan.

- The member will save nearly $21,150 in interest with a 48 Natco loan compared to paying only the minimum payment on three separate credit cards.

Plus, the member elected credit life and credit disability on the consolidation loan. This gives him peace of mind that should he become injured, sick or pass away during the life of the loan, his family will not be burdened with the debt.

Now, the member is on a path with a brighter outcome in just 4 years. We would love to talk with you to see how we can help you achieve REAL FREEDOM too. Give us a call at 962-2561 to speak to a loan expert or apply for a consolidation loan today.